Key Points:

- The SKR Price surged abruptly to above 350% within 24 hours, with the SKR Price reaching a high of approximately $0.0615 following Solana Mobile’s disbursement of SKR tokens to Seeker Phone subscribers.

- Roughly 2 billion SKR tokens were airdropped, but there are over 3.8 billion tokens staked, which greatly reduces the potential for selling pressure

- The driving forces behind this rally are mainly supply restrictions and yield advantages, and not organic demand in the utility space for SKR.

Airdrop From Solana Mobile Created an Immediate Supply Shock

Solana Mobile Snapshot has distributed close to 2 billion SKR to users of Seeker Phones as well as to developers who are components of its ecosystem, which approximates 20% of total supply. This sparked a massive influx of tokens into the market.

As opposed to a collapse amidst the airdrop sell-off, the SKR token price skyrocketed as SKR went live on Coinbase, Bitget, Bybit, and Solana DEXs, coupled with Hyperliquid‘s launch of perpetual contracts that supercharged speculation.

This is because the rally is a reflection of traders monetizing a “seeker airdrop” narrative in the marketplace in terms of SKR as a liquidity play in relation to hardware Web3 and not a usage demand play.

Staking Mechanics Are Propping Up SKR Price

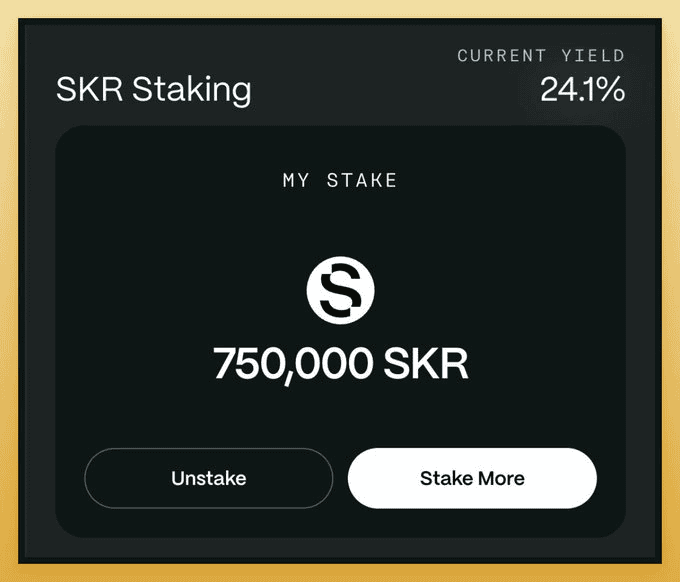

Although roughly 5.7 billion SKR are in circulation, about 3.8 billion tokens are currently locked into staking contracts, which means a majority of the supply cannot be freely sold despite the massive airdrop.

SKR enforces a 10% inflation rate in its first year while offering nearly 24% staking APY and a 48-hour unstaking cooldown, a structure that strongly incentivizes holders to lock their tokens instead of sending them back to the market.

Therefore, the SKR price has become a function of a yield-oriented trade in which the SKR value has started to be sustained by the compounding of reward tokens rather than economic activity in the Solana Mobile Leader ecosystem itself.

Weak Utility Leaves SKR Price Exposed Over Time

In this current state, SKR offers mostly governance power and minimal ecosystem benefits like discounts on fees, but there is not a single, core purpose that compels holders to lock up meaningful amounts of the token, let alone burn it.

If the Seeker ecosystem fails to offer a killer application that requires substantive use of the SKR, the unlocking of staking positions may impose strong selling pressures on the market, thereby disrupting the current SKR price structure.

| Disclaimer: This website provides information only and is not financial advice. Cryptocurrency investments are risky. We do not guarantee accuracy and are not liable for losses. Conduct your own research before investing. |