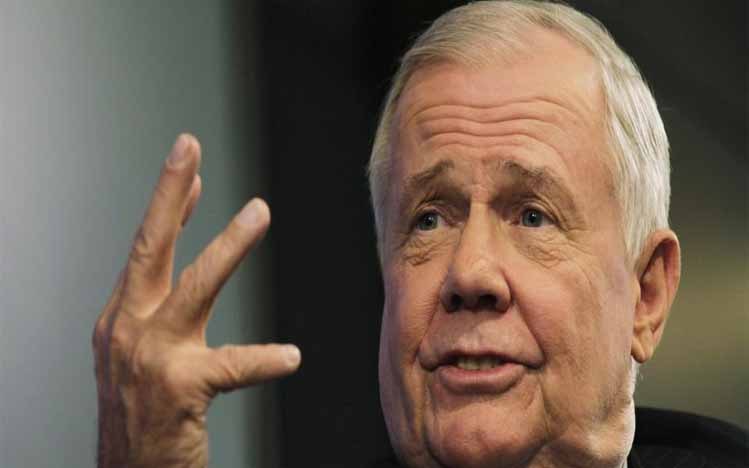

KANALCOIN NEWS – Jim Roger, a well-known investor and founder of Quantum Fund and Soros Fund Management, gave a stern warning regarding the global investment market bear market.

Reporting from Bitcoin News, Jim Roger highlighted the worrying surge in global debt over the last 14 years as a key factor in the crisis that must be anticipated. This was revealed in an interview with Real Vision.

A bear market is a market condition that experiences price declines that occur over a long period of time. This happened amid negative investor sentiment.

Bear markets are the opposite of bull markets. A bull market is a long period of price increase due to higher demand than supply.

In 2008, the bear market that occurred in America was caused by debt that was too high. And since 2009, the global debt is unprecedented.

“We should always be worried about Washington. They have no clue what they are doing. And they are proving it day after day,” explained Jim Roger in the interview.

Bear markets are not only caused by increased debt. But also the trend of global de-dollarization. Where many people are looking for alternative currencies other than dollars. It is this concern over the huge debt burden borne by the US that drives this de-dollarization movement.

The use of the US dollar as a weapon by America, such as the imposition of an embargo on Russia and its allies, actually provides a sufficient reason for other countries to reduce their dependence on the US currency. This is a compelling reason to accelerate the de-dollarization movement.

Even the de-dollarization movement has made the United States’ allies also worry that they will be affected too. For that, these countries are also moving. So that the movement to find an alternative to the USD is getting faster.

What’s more, the trend of using cryptocurrencies for global transactions, which will soon be spearheaded by Russia, is getting more intense. If successfully implemented, it is not impossible that crypto will shift the role of the USD as a medium of international trade exchange.

“You should be very worried. If you don’t, you don’t know what’s going on,” added Jim warned.

Jim also said that the existence of the dollar as a global currency would end. Investors in developed and developing countries have been looking for alternative currencies other than the dollar. And that means, something bad with the currency is going to happen two or three years from now.

It’s not just about dedollarization. Jim also reminded about the increase in interest rates. The central bank is likely to raise interest rates to deal with inflation that occurs.

“The world has never seen this much debt, spending and money printing in recent years. So something very disastrous is going to have to happen to solve the problem this time around,” Jim asserted.

Jim also explained that all financial and investment markets such as stocks, bonds and forex would experience significant challenges. And the impact of this crisis for the world is quite wide and large.

It is important for every individual and policy maker to see the ever-evolving financial landscape. Monitor developments to make the most appropriate decisions.

(*)