Key Points

- Farcaster not shutting down. The protocol remains live with roughly 250,000 monthly active users and more than 100,000 funded wallets, even as Merkle returns $180 million and Neynar takes over operations.

- The $180 million capital return reflects the collapse of a venture-backed business model, not the failure of the Farcaster network, which continues to operate as an on-chain social and identity layer.

- Neynar’s takeover positions Farcaster as infrastructure, integrating its social graph, wallets, and developer APIs into a broader financial and application ecosystem.

Reports that Farcaster was “shutting down” spread quickly after news broke that the company behind it would return $180 million to investors and hand control of the platform to Neynar. In the early hours after the announcement, social media and trading desks treated it as if one of crypto’s most visible decentralized networks had collapsed.

In reality, Farcaster not shutting down is the central fact that many initial reactions missed. What changed was not the protocol itself, but the venture-backed company that once managed it. The Farcaster network, its users, and its on-chain social graph all remain active.

This distinction matters because it reveals how decentralized social is evolving from an idealistic experiment into a piece of financial infrastructure. The story of Farcaster not shutting down is ultimately about who controls the rails, not whether the network survives.

The Origin of the Farcaster Shutdown Narrative

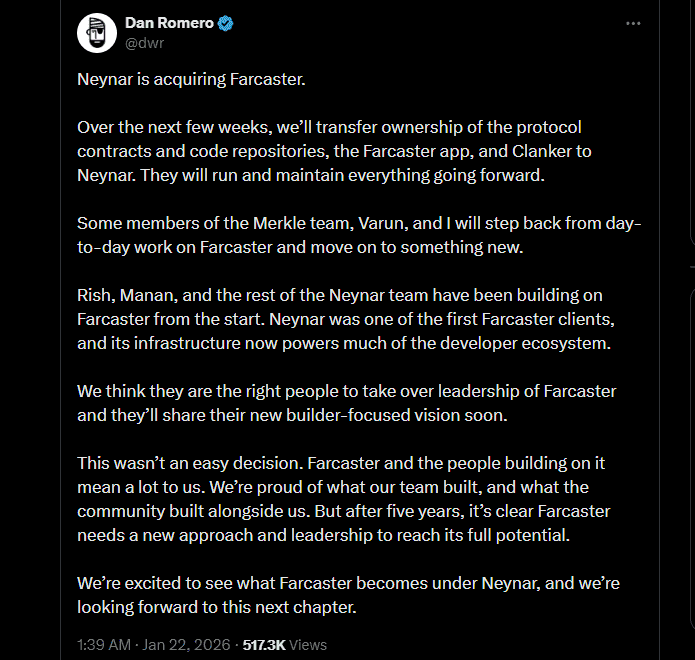

The rumor cycle began when several separate developments were compressed into a single storyline. Merkle, the venture entity behind Farcaster, announced it would return all capital to investors. At the same time, Neynar confirmed it would take over the Farcaster stack and its ongoing operations.

Those two events were framed as a shutdown, even though neither involved disabling the protocol or removing users. The idea that Farcaster was being turned off was never part of the actual announcement.

Understanding why Farcaster not shutting down was lost in the headlines requires separating corporate decisions from protocol reality.

How the shutdown headline was created

Merkle’s decision to refund $180 million was widely interpreted as Farcaster collapsing, even though the protocol itself never stopped running. The company simply chose not to continue operating a VC-scale business around it. Neynar’s acquisition of Farcaster’s code, contracts, and official client was reported as a sale, but it was in practice a transfer of operational responsibility rather than a liquidation of the network.

Protocol exit versus network survival

Farcaster is an on-chain social protocol with its own users, wallets, and identity layer. Those elements do not vanish when a corporate wrapper changes hands. What ended was Merkle’s role as a venture-funded steward, not the existence of the Farcaster network itself. This is why Farcaster not shutting down is not just a slogan but a structural reality of how decentralized systems are built.

Farcaster’s Operational Status After the Neynar Transfer

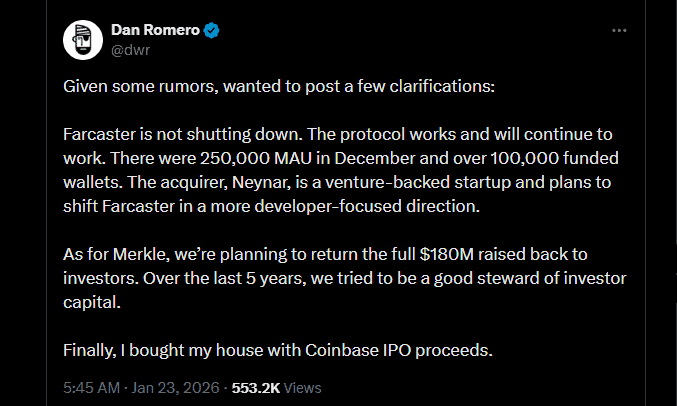

Farcaster co-founder Dan Romero publicly addressed the confusion and made it clear that the protocol remains open. He stated that Farcaster had roughly 250,000 monthly active users and more than 100,000 funded wallets in December, demonstrating that the network continues to be used at scale.

Romero also confirmed that Neynar, a venture-backed infrastructure company, would guide Farcaster in a more developer-focused direction. That shift reflects a change in strategy, not a shutdown of the protocol.

Taken together, these signals reinforce that Farcaster not shutting down is the correct interpretation of what is happening.

Romero’s clarification and current network activity

Romero’s statement draws a clean line between the protocol and the company. The Farcaster social graph, wallet system, and identity layer are still running and still being used by builders and users.

Only the management structure around them is changing, with Neynar now responsible for operations, maintenance, and future development.

The $180 Million Capital Return and Merkle’s Exit

Returning the full $180 million raised by Merkle is unusual, but it reflects the economic reality Farcaster faced. Despite its visibility and cultural relevance, the protocol generated under $10 million in annualized revenue while burning far more to operate.

This gap made it impossible to justify a billion-dollar venture valuation, even with a sizable user base. Capital discipline eventually caught up with narrative. The result was a corporate exit that leaves Farcaster not shutting down, but freed from an unsustainable VC structure.

Farcaster’s business metrics did not support the expectations placed on a venture-funded startup. Revenue fell sharply in 2025 while operating costs remained high.

By refunding investors, Merkle preserved credibility and avoided turning the project into a long-running financial drain that could have damaged both founders and backers.

Neynar’s Role as Farcaster’s Infrastructure Layer

Neynar is not a late-stage buyer parachuting into the ecosystem. For years it has operated as Farcaster’s cloud service layer, providing hosted hubs, APIs, signer management, and account creation tools that most Farcaster applications already rely on.

Even data platforms like Dune source Farcaster tables directly from Neynar’s systems, making it the protocol’s de facto infrastructure provider.

This meant Neynar already controlled much of how Farcaster was accessed and used by developers long before the acquisition.

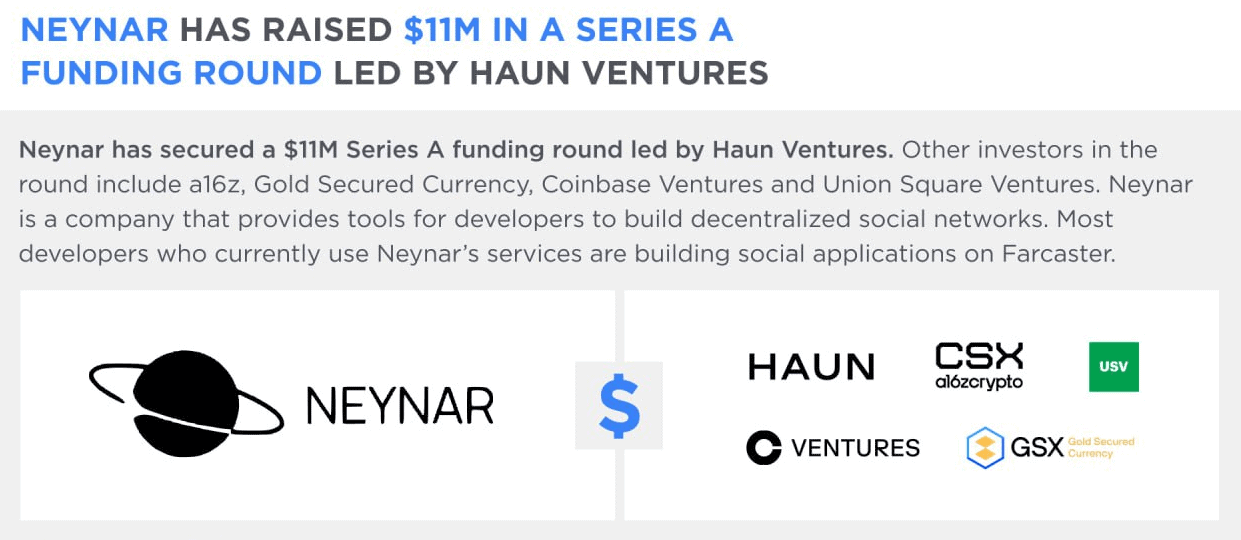

The company’s leadership comes from the Coinbase network, with both its CEO and CTO having managed large-scale crypto systems there. Neynar also raised $11 million from Haun Ventures, USV, Coinbase Ventures, and a16z CSX, with Farcaster’s founders as early backers.

That history makes Neynar less an external buyer and more an internal evolution of the Farcaster ecosystem, which is another reason Farcaster not shutting down was always the most likely outcome.

What Farcaster Not Shutting Down Means for the Market

Market behavior supports the view that Farcaster is not collapsing. Tokens tied to its ecosystem declined only modestly after the announcement, suggesting traders had already discounted the weakness of standalone social.

If the protocol itself were dying, a much deeper selloff would have been expected. Instead, the market appears to be repricing Farcaster as infrastructure rather than as a consumer social product.

This transition points to a broader shift in crypto, where social networks may struggle alone but become economically meaningful when embedded into wallets, trading platforms, and identity systems.

Farcaster’s move under Neynar reflects that reality and explains why Farcaster not shutting down is not a contradiction, but the logical next phase of its evolution.

| Disclaimer: This website provides information only and is not financial advice. Cryptocurrency investments are risky. We do not guarantee accuracy and are not liable for losses. Conduct your own research before investing. |