Cathie Wood’s ARK Invest is buying crypto equities in 2026 as part of an anti-cyclical, long-term strategy focused on infrastructure. During the February 2026 sell-off, when Bitcoin dropped below $75,000, ARK invested over $72 million into crypto-related stocks.

The fund prioritizes AI and blockchain platforms to capture adoption upside while limiting direct price volatility. ARK’s liquidity signals point to selective risk-taking under tight macro conditions.

Daily trade disclosures and spot Bitcoin ETF flows guide portfolio rebalancing decisions. At the same time, high bond yields, Japan-driven liquidity shocks, counterparty exposure, and regulatory risk remain key constraints.

Why Cathie Wood’s ARK Invest Is Buying Crypto Equities Today

Cathie Wood’s ARK Invest is actively buying crypto equities because it views the current market as a cycle entry point where downside risk has largely been priced in, while the long-term upside of crypto infrastructure remains intact.

During early February 2026, Cathie Wood’s ARK Invest deployed more than $70 million into crypto-related stocks as Bitcoin corrected below the $80,000 level.

- Crypto equities are cheaper than Bitcoin on a cycle-adjusted basis: exchange stocks, stablecoin issuers, and infrastructure companies declined more sharply than BTC during the risk-off phase.

- A systematic “buy-the-dip” strategy: ARK has repeatedly accumulated during periods of weakness in late 2025 and early 2026, indicating a rules-based approach rather than opportunistic or emotional buying.

- Long-term conviction in adoption: ARK continues to view Bitcoin and crypto as a diversified asset class with structurally low correlation to equities and bonds over the long run.

How Crypto Stocks Track Bitcoin: Beta, Average Daily Volume (ADV), Market Depth

Crypto stocks do not move 1:1 with Bitcoin, but they typically exhibit higher beta during periods of elevated volatility. This explains why Cathie Wood’s ARK Invest prefers accumulating crypto equities during drawdowns rather than allocating exclusively to Bitcoin.

| Factor | What it Measures | Impact on Crypto Equities |

|---|---|---|

| Beta | Sensitivity of crypto stocks relative to Bitcoin | Stocks such as Coinbase, Robinhood, and BitMine often have beta > 1 versus BTC, meaning they decline more sharply during Bitcoin drawdowns but recover faster when capital flows return. |

| Average Daily Volume (ADV) | Liquidity and trading activity | ADV typically contracts during risk-off phases, widening price ranges and creating entry points for Cathie Wood’s ARK Invest. |

| Market Depth | Order-book thickness and execution capacity | When market depth is thin, ETF flows or institutional buying can move crypto equities more aggressively than BTC spot markets. |

Evidence from early February 2026 shows that amid a sharp decline in overall crypto trading volume, crypto-related stocks came under significantly greater pressure than Bitcoin, consistent with the cyclical beta framework ARK follows.

What ARK Daily Trade Disclosures Signal For Flows, Volatility, Risk-Off

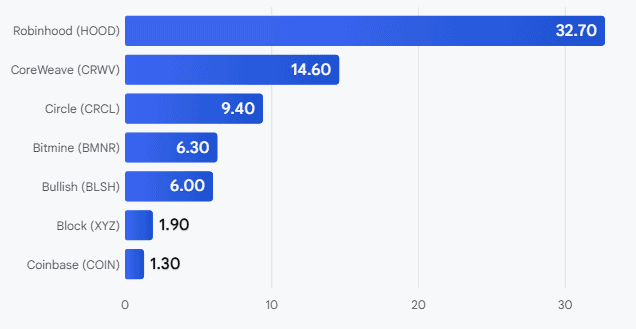

Cathie Wood’s ARK Invest uses daily trade disclosures as a real-time signal for institutional liquidity and risk appetite. Recent disclosures show Cathie Wood’s ARK Invest increasing positions in crypto-related stocks while trimming mature growth sectors. Recent filings show ARK consistently:

- Increasing positions in Robinhood, Circle, BitMine, Bullish, and Coinbase

- Reducing exposure to consumer and advertising stocks such as Trade Desk and Airbnb

Strategic implications:

- Flows: Capital is not exiting the market; it is being reallocated toward assets with higher sensitivity to the next technology and crypto cycle.

- Volatility: ARK accepts short-term volatility in exchange for long-term convex upside.

- Conditional risk-off: This is not a broad risk-off move, but a rotation away from mature growth models and an early risk-on stance toward next-generation financial infrastructure.

Watchlist: Coinbase, Robinhood, BitMine Correlation Setup

Coinbase: ADV vs ETF inflows, market depth sensitivity

Coinbase is the crypto stock most directly exposed to the structural shift from spot trading to ETF-driven liquidity. In 2026, Coinbase’s performance is no longer a pure proxy for Bitcoin’s price. It is a proxy for where trading activity occurs.

- ADV vs ETF inflows: As capital flows into spot Bitcoin ETFs, retail trading volumes on centralized exchanges fail to scale proportionally. This decoupling pressures Coinbase’s core transaction revenue.

- Fee compression: ETFs offer lower effective costs, reducing incentives for direct exchange trading and compressing margins.

- Market depth sensitivity: During deleveraging events, the lack of institutional bid support on exchanges increases volatility, pushing COIN’s beta higher than Bitcoin’s.

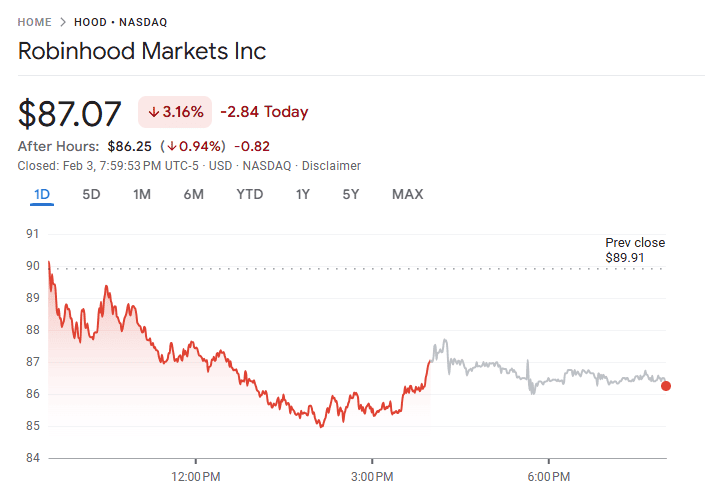

Robinhood and BitMine: trading volume elasticity to Bitcoin

Robinhood and BitMine both respond to Bitcoin volatility, but through different elasticity mechanisms tracked by Cathie Wood’s ARK Invest.

Robinhood (HOOD): retail-driven elasticity

- Trading volume expands sharply during bullish momentum phases due to FOMO and wealth effects.

- Volume does not increase symmetrically during downturns, making HOOD relatively more resilient on the downside.

- By 2026, crypto contributes a smaller share of total revenue due to diversification into prediction markets and continuous equity trading.

BitMine (BMNR): asset- and NAV-driven elasticity

- BMNR behaves like a leveraged treasury vehicle with near-linear correlation to underlying crypto assets.

- Volume surges during both rallies and sell-offs as investors reprice NAV and manage leverage.

- Large unrealized gains or losses amplify volatility independent of sentiment.

BMNR functions as a high-conviction volatility instrument within Cathie Wood’s ARK Invest framework. It is suitable only for investors comfortable with extreme price swings.

Risk Factors: Macro Yields, Japan, Liquidity, Regulatory Overhang

Exchange-traded funds (ETFs): flows and volatility feedback

Spot Bitcoin ETFs have become the primary liquidity gateway for institutional capital, while simultaneously amplifying volatility.

Key mechanisms:

- Capital inflows: ETF inflows lift Bitcoin prices, expand the net asset value of crypto-exposed companies, and attract speculative equity flows that often overshoot fundamentals.

- Capital outflows: ETF redemptions force spot selling of Bitcoin, compress valuations of crypto equities, and trigger margin-driven liquidations in high-beta stocks.

- Liquidity concentration: Trading activity increasingly clusters around U.S. market hours, making crypto equities more sensitive to macroeconomic data releases and policy signals.

This feedback loop magnifies both upside and downside moves in crypto-related stocks.

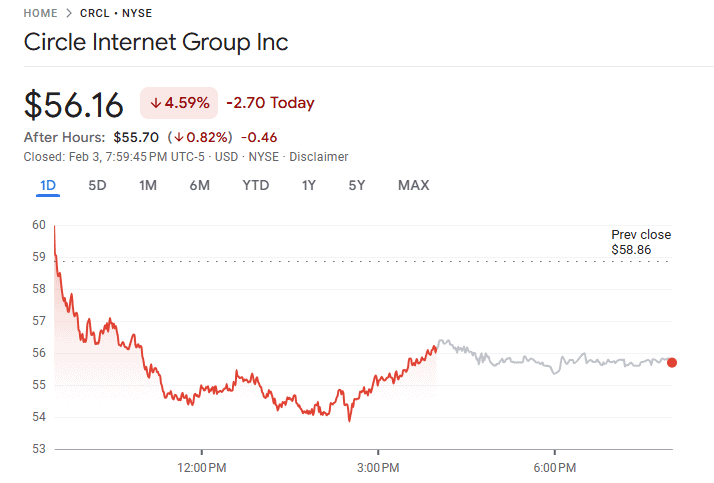

Counterparties: Circle, CoreWeave, Alphabet exposure pathways

The largest hidden risks to crypto equities now come from traditional financial and technology counterparties.

Circle

- Revenue depends heavily on yields from U.S. Treasuries backing stablecoins.

- Aggressive rate cuts could compress margins sharply.

- Banking or liquidity stress could reignite stablecoin confidence concerns.

CoreWeave

- Exposure to AI compute demand ties crypto infrastructure to the AI investment cycle.

- Rising capital costs or GPU supply disruptions would directly impair scalability.

- A downturn in AI expectations could cascade into crypto infrastructure valuations.

Alphabet

- Acts simultaneously as infrastructure provider (via cloud services) and competitor (via payments and financial tooling).

- Policy or pricing changes could raise costs for crypto-native firms.

- Platform-scale competition threatens smaller brokerages and exchanges.

Together, these dependencies create systemic, non-Bitcoin risks that can trigger chain reactions even in stable crypto price environments.

| Disclaimer: This website provides information only and is not financial advice. Cryptocurrency investments are risky. We do not guarantee accuracy and are not liable for losses. Conduct your own research before investing. |